Outrageous Info About How To Check Vat Number

You can now find the vat number of any business by using their commercial registration (cr) number on the zakat, tax and customs authority ( zatca) website.

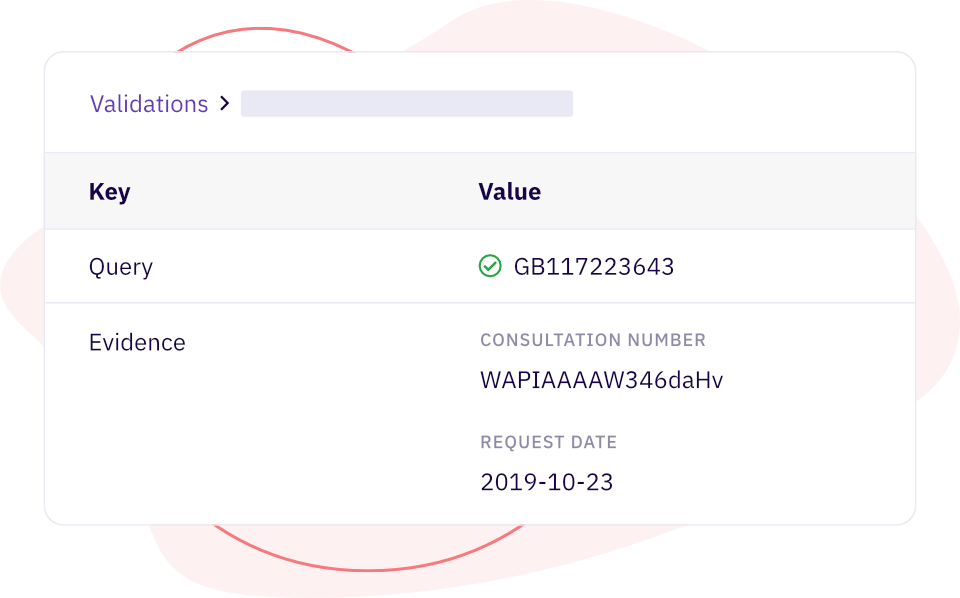

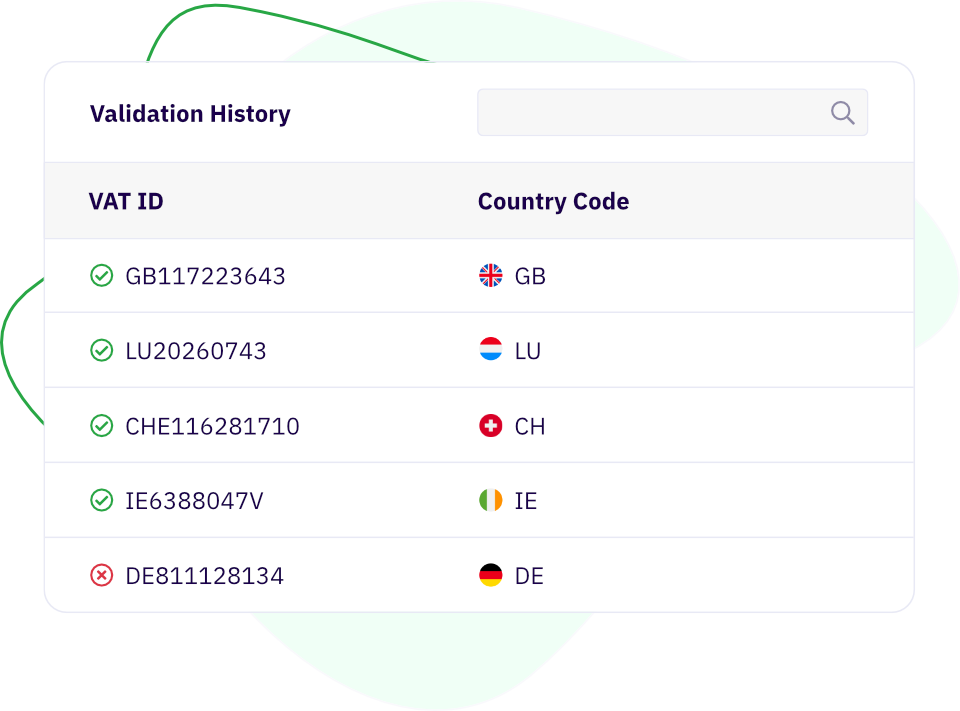

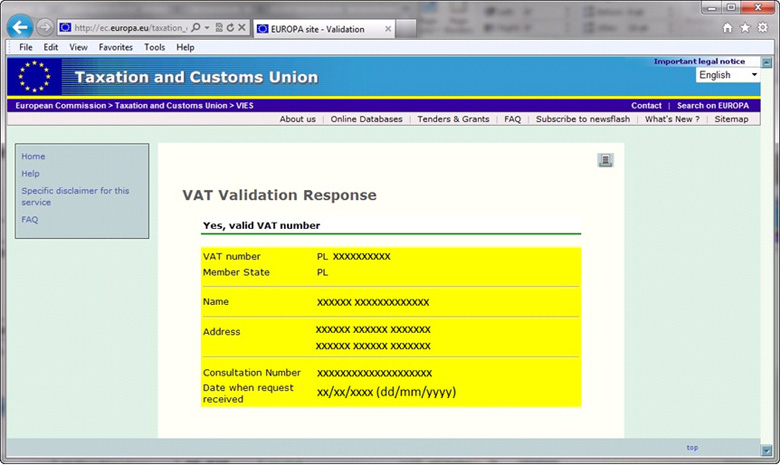

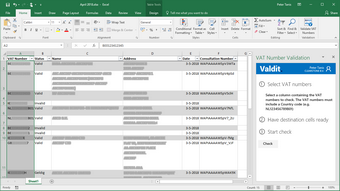

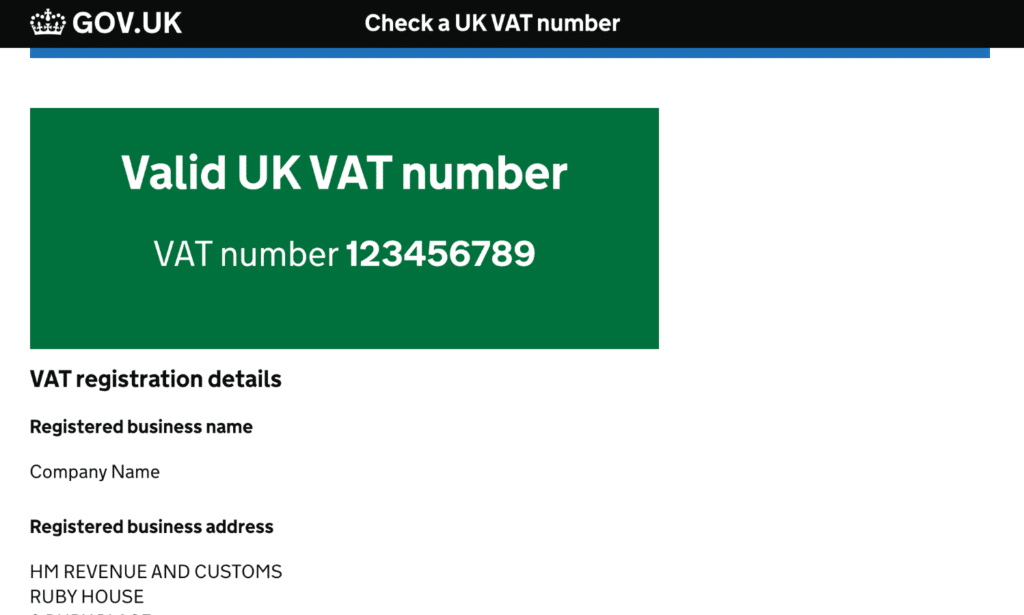

How to check vat number. The vat vendor search is designed to only verify a vat registration number if the exact correct trading name has been entered. Eu vat number check fails every time. For more information about vat number validation or cross border tax.

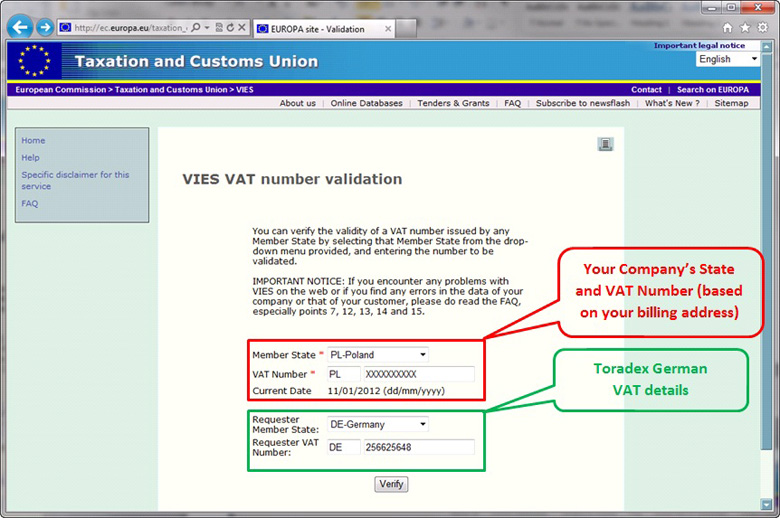

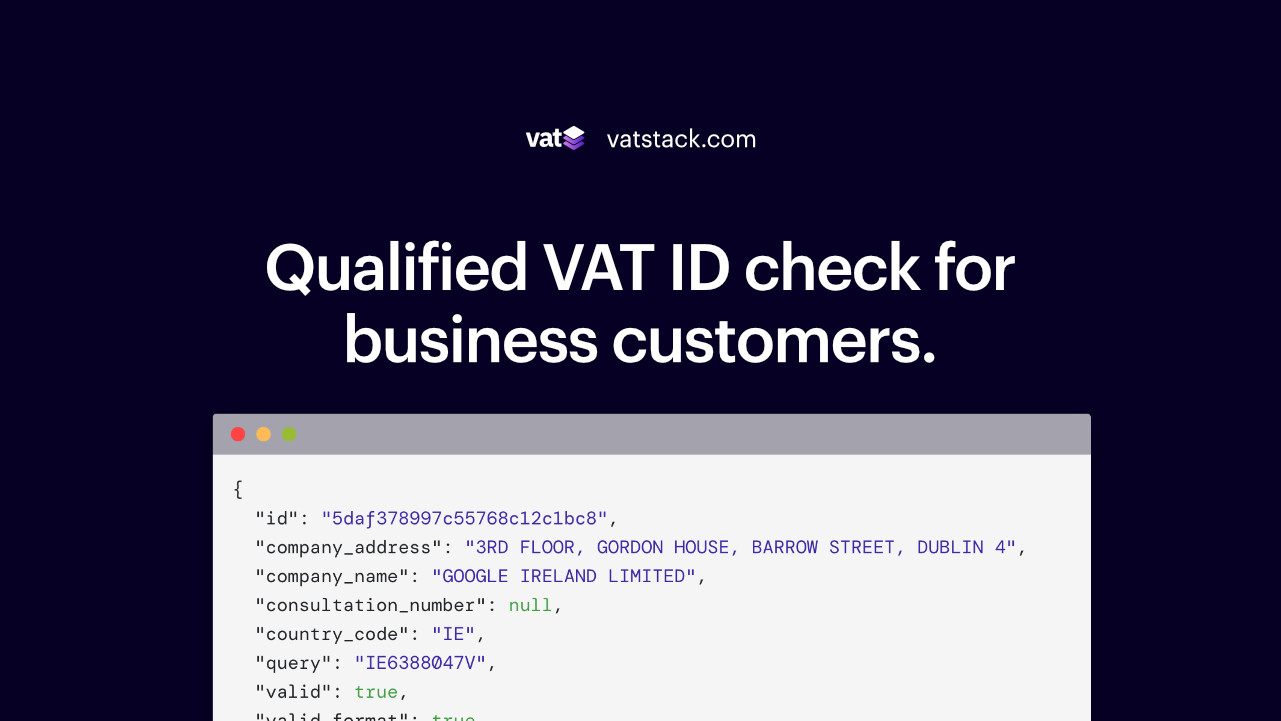

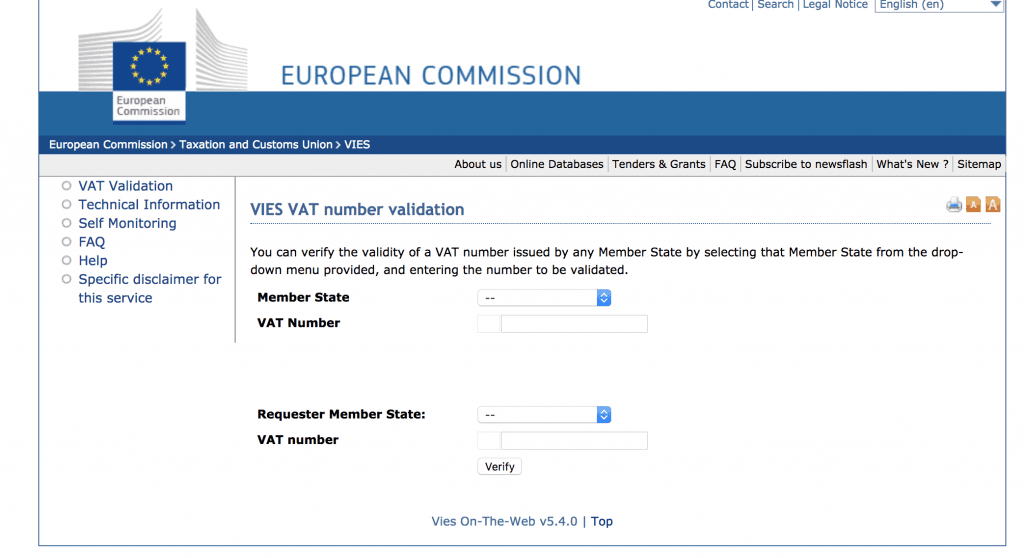

1) apply for a tax identification number (tin) in your country of residence by submitting documentation and waiting for approval; Available to taxpayers and the public. If you want to verify the validity of your client's vat identification number, you can use the european commission's vies vat number validation (vat information exchange system,.

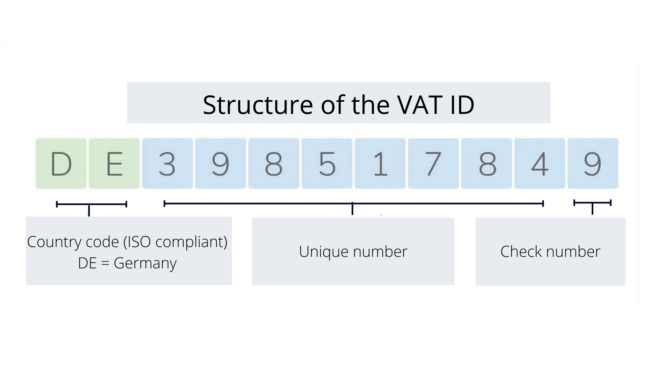

You will have to verbally answer the questions from form rc1. In order to check for a vat number in europe you need to first have the vat number at hand. Checking table for vat number.

As i am based in sd, i have a question refering fi module, to which i haven't found an answer yet. Enter a minimum of 5 characters to get a listing of possible matches, continue to add characters to the search criteria until it narrows the. By filling out form rc1, request for a business number (bn) and mailing or faxing it.

There are two ways to obtain a vat number: Consequently, where vendors are newly. Use this service to check:

( vat number in austria always insert „u“ before the digits) che 000000000. Friday at 06:18 pm in help & support. In order to check if a vat number is valid, simply go to validation link shown below: